Have you considered trading with other markets? There has never been a time quite like this one before where moving on to other markets, such as metals and oil, was more possible and with so much potential to bring you profit.

Trading has always been a universal concept. Pre-historic people bartered a variety of goods and services, which was a natural modern-day currency predecessor. As the times change, and they change fast, even as close as three decades ago people did not have the same information and tools at their disposal as we do now.

A relatively recent history of trade tells us how substantial quantities of money were required for anyone who desired to trade anything. People used to face quite limiting market rules and, as a result, the talent itself could not be an asset strong enough to even get you to start off in this line of business. Probably due to these past struggles, present-day men or women may be struggling with fears concerning this topic. People probably have an opinion that tens of thousands of dollars are necessary for anyone to start trading on the stock market.

Individuals who happen to have quantities of money necessary to trade more than one stock are, from the perspective of a forex trader, very likely to face severe limitations pursuant to this type of business – from orders which did not get filled to capital gains taxes. Nowadays, most of the issues related to stock trade are not applicable any longer. We are, in fact, witnessing a great momentum where we can do trade without a lot of money. This is not a suggestion to pursue trading without sufficient financial security, but it is an indication that we have the opportunity to experience an unforeseen variety of possibilities in trade.

Owing to CFDs, contracts for difference, we can now trade anything, from sock to indices. Although created a few decades ago, Australians were the first to use it in exchange, first offering it in 2007. CFDs help traders trade prices, not the actual stocks or commodities for example. A person who does not own stock in a company, but is trading its price, is actually earning a profit if the price goes their way and vice versa. Owning alone can be dangerous because if the prices go down, it is questionable whether anyone would be interested in buying a falling stock.

Forex traders, unlike stock traders, always get their orders filled whenever they want due to two reasons. The number one reason is liquidity – there will always be someone to hold the fort. An ECN broker or a dealing desk broker for example will take the other side of the trade. CFDs behave in the same way, taking the other side of the trade.

Now unlike ECN brokers, dealing desk brokers are required to take the other side of all orders, regardless of how successful a trader is. This an amazing opportunity because it implies that your order will be filled each time and that your stop-loss and take-profit points will be honored, wherever you put them. Today, luckily, people need only click one button and insert their numbers to be in a short trade that easily.

While the previously mentioned facts hold, some rare market phenomena (flash crash, large gaps, etc.) might not apply. However, in everyday circumstances, you should not be worrying over the question of whether your order will be accepted or not. The fact that you can short everything easily opens many possibilities. If you are a longer-term trader, for example, and the market goes into recession, which naturally occurs from time to time, you may choose not to do many long trades, which was completely impossible before. In such situations, people really could not short an entire index before or, even if it was possible, it used to be a strenuous process.

Approximately 11 years ago, when the U.S. market went into recession, people had little knowledge of this possibility and very few brokers had any CFDs to offer. Nowadays, this kind of knowledge can be extremely useful in times of recession. Holding precious metals is a perfect example – making a profit during a recession without having to hold great quantities of precious metal is now possible. The only thing you have to do here is to write a stock down or write an entire index down.

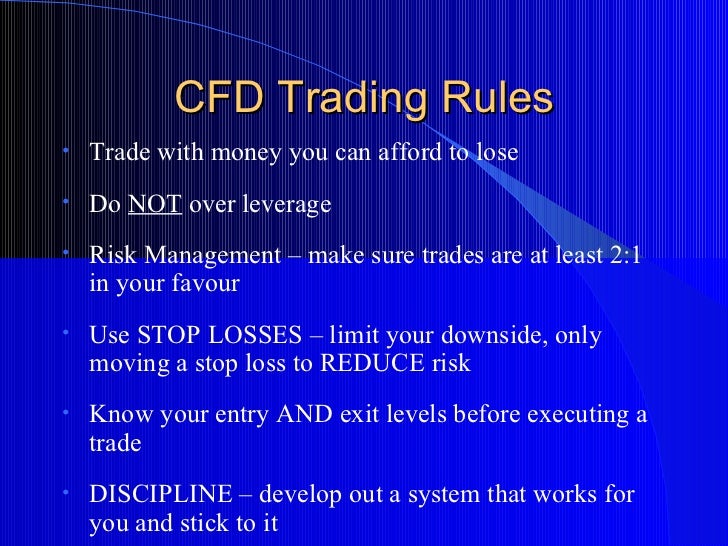

There are, however, a few things a trader should be cautious about. There is always a greater power making large financial decisions that impact entire markets. In 2008, only a handful of individuals knew that the market would crash, which was even documents in a movie called Big Short. Even from the perspective of history, recessions have always helped the wealthiest individuals acquire even more. The information concerning the onset of such big changes, and even their direction, is always in the hands of the lucky few decision-makers. Therefore, when everyone is vocal about the necessity to go long on the stock market, that may be the time to do exactly the opposite. In 2008, after everyone was insistent on going long, the market crashed, which should now serve as an invaluable lesson.

Nowadays, luckily, there is a massive quantity of materials online which can help you educate yourself on various topics, especially finance. Social media has made information and knowledge accessible to the extent that we have the opportunity to hear financial statistics and forecasts unlike ever before. With a great number of individuals making podcasts on the probability of the market crashing, listing the numerous reasons supporting their viewpoints, people now understand red flags and truly comprehend the circumstances revolving around the previous recessions. Although financial networks are trying to hide the facts and stop the information from spreading, people have now learned how to recognize warning signs and explain such trends at present.

As opposed to the times of previous recessions, traders are now equipped with important tools such as CFDs. When a recession does happen, this is what will help many people emerge as winners. Until today, there have been quite a few false alarms, pushing people to take actions too soon. Nevertheless, we know now that each one of us has the ability to do something despite the direction the market is heading to. What is more, we can trade on every trading day, an all of this is possible owing to CFDs.

While contacts for difference may not be accessible from all places on this planet, there is a way to go around present limitations. We may not know when the next recession is going to strike, but CFDs are going to be our greatest ally when it does, allowing everyone to have an advantage regardless of the financial status.

If you have a computer or a laptop, you still have the chance to succeed at this. Grow your skills and knowledge and you may come across someone who will find your expertise in trading oil, or anything else, invaluable. There is such an abundance of options nowadays. We can enjoy ways and possibilities in trading which generations before couldn’t, and despite any circumstances become professionals trading large sums of money.